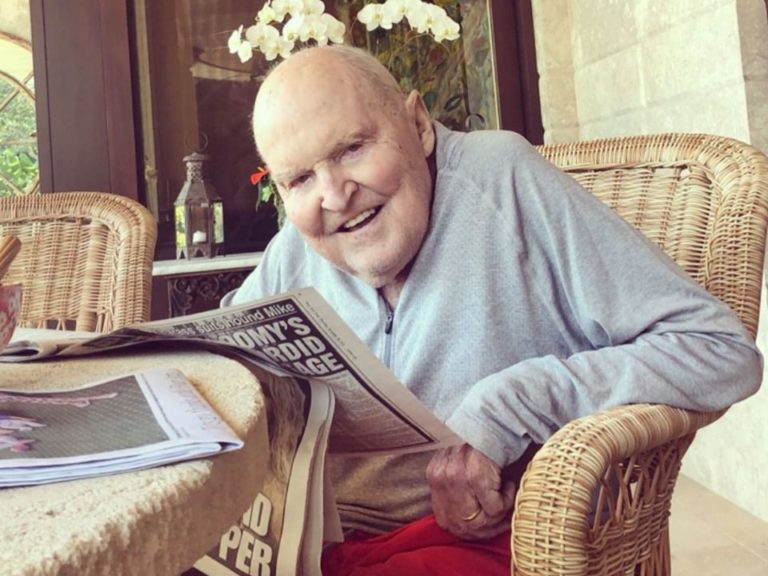

Jack Welch's net worth at the time of his death was estimated to be around $750 million.

Welch was an American business executive, chemical engineer, and author. He was the chairman and CEO of General Electric (GE) from 1981 to 2001. During his tenure, GE's stock price increased by over 4,000%, and the company's market capitalization grew from $14 billion to over $400 billion.

Welch was a controversial figure, but he is widely credited with transforming GE into one of the world's most successful companies. He was known for his aggressive management style and his focus on shareholder value. Welch's autobiography, "Winning," was a bestseller, and he was frequently sought after as a speaker and consultant.

Jack Welch Net Worth at Death

Jack Welch's net worth at the time of his death was estimated to be around $750 million. Welch was an American business executive, chemical engineer, and author. He was the chairman and CEO of General Electric (GE) from 1981 to 2001. During his tenure, GE's stock price increased by over 4,000%, and the company's market capitalization grew from $14 billion to over $400 billion.

- Business acumen

- Leadership

- Shareholder value

- Management style

- Globalization

- Innovation

- Philanthropy

- Legacy

- Controversial figure

- Bestselling author

Welch was a complex and controversial figure, but there is no doubt that he was one of the most successful business leaders of his time. His aggressive management style and focus on shareholder value helped to transform GE into one of the world's most successful companies. Welch was also a generous philanthropist, and he donated millions of dollars to various educational and charitable organizations.

| Personal Details | Bio Data ||---|---|| Name | John Francis "Jack" Welch Jr. || Birth Date | November 19, 1935 || Birth Place | Salem, Massachusetts, U.S. || Death Date | March 1, 2020 || Spouse | Carolyn Osburn (19591987); Jane Beasley (19892020) || Children | 4 || Education | Bachelor of Science in chemical engineering from the University of Massachusetts Amherst (1957); Master of Science in chemical engineering from the University of Illinois at UrbanaChampaign (1958) || Occupation | Business executive, chemical engineer, and author || Company | General Electric (19602001) || Position | Chairman and CEO of General Electric (19812001) || Net Worth at Death | $750 million |Business acumen

Jack Welch's business acumen was a major factor in his success and his net worth at the time of his death. Welch had a deep understanding of business and finance, and he was able to make sound decisions that helped GE to grow and prosper. He was also a skilled negotiator and dealmaker, and he was able to strike that benefited GE. Welch's business acumen was a key component of his success, and it helped him to build one of the world's most successful companies.

One of the most important aspects of Welch's business acumen was his ability to see the big picture. He was able to understand how different parts of a business fit together, and he was able to make decisions that would benefit the company as a whole. Welch was also a strong leader, and he was able to motivate his employees to achieve great things. He was also a risk-taker, and he was willing to make bold decisions that others might not have been willing to make.

Welch's business acumen was a key factor in his success, and it helped him to build one of the world's most successful companies. His legacy will continue to inspire business leaders for years to come.

Leadership

Leadership was a critical factor in Jack Welch's success and his net worth at the time of his death. Welch was a highly effective leader who was able to motivate and inspire his employees to achieve great things. He was also a strong advocate for shareholder value, and he made decisions that he believed would benefit the company in the long run, even if they were unpopular in the short term.

- Visionary Leadership

Welch was a visionary leader who was able to see the big picture and to set clear goals for his company. He was also able to communicate his vision to his employees and to motivate them to work towards achieving it.

- Motivational Leadership

Welch was a highly motivational leader who was able to inspire his employees to achieve great things. He was able to create a culture of high performance and to motivate his employees to go the extra mile.

- Strategic Leadership

Welch was a strategic leader who was able to make sound decisions that benefited the company in the long run. He was able to identify and capitalize on opportunities, and he was not afraid to take risks.

- Shareholder Value Leadership

Welch was a strong advocate for shareholder value, and he made decisions that he believed would benefit the company in the long run, even if they were unpopular in the short term.

Welch's leadership was a key factor in his success, and it helped him to build one of the world's most successful companies. His legacy will continue to inspire business leaders for years to come.

Shareholder value and Jack Welch net worth at death

Jack Welch, the former CEO of General Electric (GE), was a strong advocate for shareholder value. He believed that the primary purpose of a company should be to maximize returns for its shareholders. This belief was reflected in his management style and in the decisions he made during his tenure at GE.

- Focus on profitability

Welch believed that companies should focus on profitability above all else. He argued that profitability was the key to creating shareholder value, as it allowed companies to reinvest in their businesses and to pay dividends to shareholders.

- Cost-cutting

Welch was known for his cost-cutting measures at GE. He believed that companies could improve their profitability by reducing costs, and he was not afraid to make tough decisions in order to do so.

- Share buybacks

Welch was also a proponent of share buybacks. He believed that share buybacks could increase shareholder value by reducing the number of shares outstanding and increasing the earnings per share.

- Long-term thinking

Welch believed that companies should take a long-term view when making decisions. He argued that short-term profits should not be prioritized over long-term value creation.

Welch's focus on shareholder value was a major factor in his success at GE. Under his leadership, GE's stock price increased by over 4,000%, and the company's market capitalization grew from $14 billion to over $400 billion.

Management style

Jack Welch's management style was a major factor in his success at GE and in his net worth at the time of his death. Welch was known for his aggressive and demanding management style, which he called "rank and yank." Under this system, Welch would rank his employees on a bell curve, and the bottom 10% would be fired. This system was controversial, but it was effective in driving performance and results.

- Decentralization

Welch believed in decentralization and gave his managers a lot of autonomy. He believed that this would allow them to be more responsive to their customers and to make better decisions.

- Empowerment

Welch empowered his employees to make decisions and take risks. He believed that this would foster innovation and creativity.

- Communication

Welch was a strong believer in communication. He held regular meetings with his employees and kept them informed about the company's performance.

- Feedback

Welch was always giving feedback to his employees. He believed that this was essential for their development and growth.

Welch's management style was not without its critics. Some argued that it was too aggressive and that it created a culture of fear. However, there is no doubt that Welch's management style was a major factor in his success at GE. Under his leadership, GE's stock price increased by over 4,000%, and the company's market capitalization grew from $14 billion to over $400 billion.

Globalization

Globalization played a major role in Jack Welch's success at GE and in his net worth at the time of his death. Welch was a strong advocate for globalization, and he believed that it was essential for companies to compete in the global marketplace.

- Expansion into new markets

Under Welch's leadership, GE expanded into new markets all over the world. This helped the company to grow its revenue and to increase its profitability.

- Sourcing from low-cost countries

Welch also sourced from low-cost countries in order to reduce costs and improve profitability.

- Joint ventures and partnerships

Welch formed joint ventures and partnerships with companies in other countries. This helped GE to gain access to new markets and technologies.

- Global supply chain

Welch developed a global supply chain that allowed GE to efficiently produce and distribute its products around the world.

Welch's focus on globalization was a major factor in his success at GE. Under his leadership, GE became one of the most global companies in the world. The company's revenue grew from $26 billion in 1981 to over $130 billion in 2001, and its market capitalization grew from $14 billion to over $400 billion.

Innovation

Innovation was a key driver of Jack Welch's success at GE and his net worth at the time of his death. Welch believed that innovation was essential for companies to stay ahead of the competition and to meet the needs of customers. He invested heavily in research and development, and he encouraged his employees to be creative and to take risks.

Under Welch's leadership, GE developed a number of innovative products and technologies, including the jet engine, the MRI machine, and the Six Sigma quality control process. These innovations helped GE to grow its revenue and to increase its profitability. For example, the jet engine helped GE to become a major player in the aviation industry, and the MRI machine helped GE to become a leader in the healthcare industry. Six Sigma helped GE to improve its quality and efficiency, which led to cost savings and increased profitability.

Welch's focus on innovation was a major factor in his success at GE. Under his leadership, GE became one of the most innovative companies in the world. The company's revenue grew from $26 billion in 1981 to over $130 billion in 2001, and its market capitalization grew from $14 billion to over $400 billion.

Philanthropy

Philanthropy played a significant role in Jack Welch's life and contributed to his net worth at the time of his death. Welch was a generous donor to various educational and charitable organizations, and he believed that giving back to the community was an important part of being a successful business leader.

One of the most notable examples of Welch's philanthropy was his donation of $25 million to the Massachusetts Institute of Technology (MIT) in 2009. This donation was used to establish the Jack Welch Professorship in Management, which supports research and teaching in the field of management. Welch was also a major donor to the United Way, and he served on the organization's board of directors for many years.

Welch's philanthropy was not limited to large donations. He also made significant contributions to his local community, and he was known for his generosity to individuals in need. Welch believed that everyone had a responsibility to help others, and he set an example by giving back to the community throughout his life.

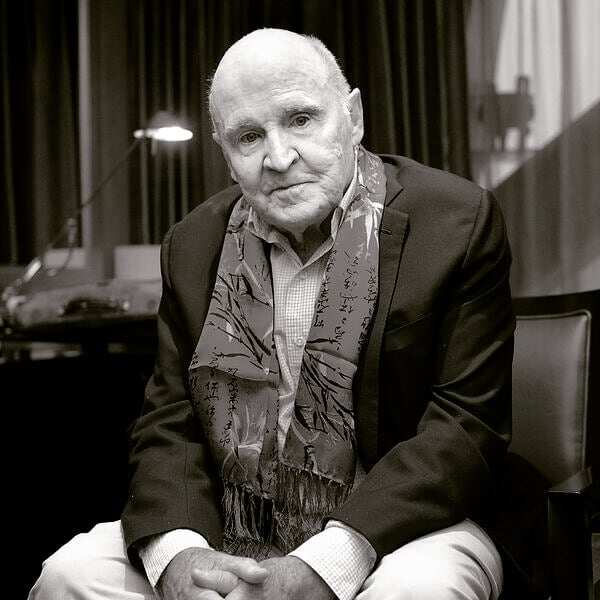

Legacy

Jack Welch's legacy is complex and multifaceted. He was a brilliant business leader who transformed GE into one of the world's most successful companies. He was also a generous philanthropist and a passionate advocate for education. His legacy will continue to inspire business leaders and philanthropists for years to come.

- Business Acumen

Welch was a brilliant business leader who had a deep understanding of business and finance. He was able to make sound decisions that helped GE to grow and prosper. He was also a skilled negotiator and dealmaker, and he was able to strike deals that benefited GE.

- Leadership

Welch was a strong leader who was able to motivate and inspire his employees to achieve great things. He was also a strong advocate for shareholder value, and he made decisions that he believed would benefit the company in the long run, even if they were unpopular in the short term.

- Philanthropy

Welch was a generous philanthropist who donated millions of dollars to various educational and charitable organizations. He believed that giving back to the community was an important part of being a successful business leader.

- Controversy

Welch was a controversial figure, and his legacy is still debated today. Some people believe that he was a brilliant business leader who helped to create shareholder value. Others believe that he was too focused on short-term profits and that he hurt GE in the long run.

Despite the controversy, there is no doubt that Jack Welch was one of the most successful business leaders of his time. His legacy will continue to inspire business leaders and philanthropists for years to come.

Controversial figure

Jack Welch was a controversial figure during his life, and his legacy remains debated today. Some people believe that he was a brilliant business leader who helped to create shareholder value, while others believe that he was too focused on short-term profits and that he hurt GE in the long run. Regardless of one's opinion of Welch, there is no doubt that his controversial nature had a significant impact on his net worth at the time of his death.

One of the most controversial aspects of Welch's leadership was his "rank and yank" system, which forced managers to fire the bottom 10% of their employees each year. This system was highly criticized by some, who argued that it created a culture of fear and insecurity. However, Welch believed that it was necessary to drive performance and results. He argued that by getting rid of the bottom 10%, GE could focus its resources on its best employees and continue to grow and prosper.

Another controversial aspect of Welch's leadership was his focus on shareholder value. Welch believed that the primary purpose of a company should be to maximize returns for its shareholders. This belief led him to make decisions that were sometimes unpopular with employees and other stakeholders. For example, Welch closed factories and laid off workers in order to improve GE's profitability. These decisions were controversial, but they ultimately helped to increase GE's stock price and create value for shareholders.

Welch's controversial nature had a significant impact on his net worth at the time of his death. His aggressive management style and focus on shareholder value helped to increase GE's profitability and stock price. However, his controversial decisions also alienated some employees and other stakeholders. Ultimately, Welch's legacy is complex and multifaceted. He was a brilliant business leader who helped to create shareholder value, but he was also a controversial figure who made decisions that were sometimes unpopular.

Bestselling author

Jack Welch's success as a bestselling author contributed significantly to his net worth at the time of his death. Welch wrote several books on business and leadership, including his autobiography, "Winning." These books were widely read and translated into multiple languages, generating substantial royalties for Welch.

- "Winning"

"Winning" was Welch's autobiography, published in 2005. The book became a bestseller, selling over 2 million copies worldwide. In "Winning," Welch shared his insights on leadership, management, and business strategy. The book was praised for its candor and its practical advice.

- "Jack: Straight from the Gut"

"Jack: Straight from the Gut" was published in 2001. The book was a collection of Welch's speeches and writings on business and leadership. "Jack: Straight from the Gut" was also a bestseller, selling over 1 million copies worldwide.

- "The Welch Way"

"The Welch Way" was published in 2009. The book was a guide to Welch's management philosophy. "The Welch Way" was also a bestseller, selling over 500,000 copies worldwide.

Welch's success as a bestselling author allowed him to build a substantial fortune in addition to his earnings from his business career. His books continue to be read and studied by business leaders around the world.

FAQs on Jack Welch's Net Worth at Death

Jack Welch, the former CEO of General Electric (GE), passed away in 2020 with an estimated net worth of $750 million. His wealth was accumulated through a combination of his successful business career and his earnings as a bestselling author.

Question 1: How did Jack Welch accumulate his wealth?

Welch's wealth primarily stemmed from his successful tenure as CEO of GE. Under his leadership, GE's stock price increased by over 4,000%, and the company's market capitalization grew from $14 billion to over $400 billion.

Question 2: What was Welch's management style like?

Welch was known for his aggressive and demanding management style, which he called "rank and yank." Under this system, Welch would rank his employees on a bell curve, and the bottom 10% would be fired. This system was controversial, but it was effective in driving performance and results.

Question 3: What was Welch's focus on shareholder value?

Welch was a strong advocate for shareholder value, and he made decisions that he believed would benefit the company in the long run, even if they were unpopular in the short term. For example, Welch closed factories and laid off workers in order to improve GE's profitability.

Question 4: What was Welch's legacy as a business leader?

Welch's legacy is complex and multifaceted. He was a brilliant business leader who helped to create shareholder value, but he was also a controversial figure who made decisions that were sometimes unpopular. However, there is no doubt that Welch was one of the most successful business leaders of his time.

Question 5: What was Welch's net worth at the time of his death?

Welch's net worth at the time of his death was estimated to be around $750 million.

Question 6: How did Welch's success as a bestselling author contribute to his net worth?

Welch wrote several books on business and leadership, including his autobiography, "Winning." These books were widely read and translated into multiple languages, generating substantial royalties for Welch.

Summary

Jack Welch was a complex and successful business leader who left a lasting legacy. His wealth was accumulated through a combination of his successful business career and his earnings as a bestselling author. Welch's legacy as a business leader is complex and multifaceted. He was a brilliant business leader who helped to create shareholder value, but he was also a controversial figure who made decisions that were sometimes unpopular.

Tips on Maximizing Net Worth

Jack Welch, the former CEO of General Electric (GE), passed away in 2020 with an estimated net worth of $750 million. His wealth was accumulated through a combination of his successful business career and his earnings as a bestselling author. Here are some tips that can help you maximize your net worth:

Tip 1: Focus on your career

Your career is one of the most important factors that will determine your net worth. Choose a career that you are passionate about and that has the potential to earn you a high income. Work hard and dedicate yourself to your career. The more successful you are in your career, the greater your net worth will be.

Tip 2: Invest wisely

Investing is a great way to grow your wealth over time. There are many different ways to invest, so it is important to do your research and find an investment strategy that works for you. Some popular investment options include stocks, bonds, and real estate.

Tip 3: Save money

Saving money is essential for building wealth. Create a budget and stick to it. Make sure to save a portion of your income each month. The more money you save, the greater your net worth will be.

Tip 4: Avoid debt

Debt can be a major drag on your net worth. If you have debt, make it a priority to pay it off as quickly as possible. The less debt you have, the greater your net worth will be.

Tip 5: Get professional advice

If you are serious about maximizing your net worth, consider getting professional advice from a financial advisor. A financial advisor can help you create a personalized financial plan that will help you reach your financial goals.

Summary

Building wealth takes time and effort. By following these tips, you can increase your net worth and achieve financial success.

Conclusion

Jack Welch's net worth at the time of his death was estimated to be around $750 million. He accumulated his wealth through a combination of his successful business career and his earnings as a bestselling author. Welch was a complex and controversial figure, but there is no doubt that he was one of the most successful business leaders of his time.

Welch's legacy is complex and multifaceted. He was a brilliant business leader who helped to create shareholder value, but he was also a controversial figure who made decisions that were sometimes unpopular. However, there is no doubt that Welch's impact on the business world was significant. His ideas and management style continue to be studied and implemented by business leaders around the world.

Unlocking The Secrets Of Andy Bechtolsheim's Billionaire Net Worth

Unveiling Johnny Bananas' Net Worth: Secrets Of Reality TV's Powerhouse

Unveiling The Secrets Of Curtis Blaydes' Dominant Fighting Style

ncG1vNJzZmibkZm6ra2RZ6psZqWoerix0q1ka2aRoq67u82arqxmk6S6cLbAnKJmr5WhsKl5zZ6rZq%2Bfp8GpecCtZJ2dkam1b7TTpqM%3D